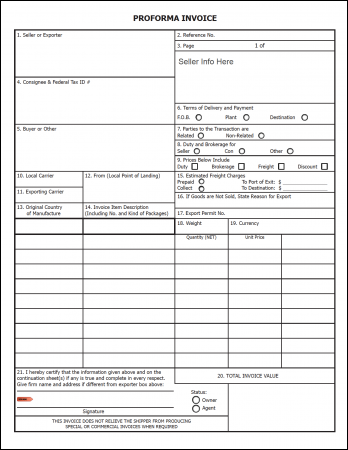

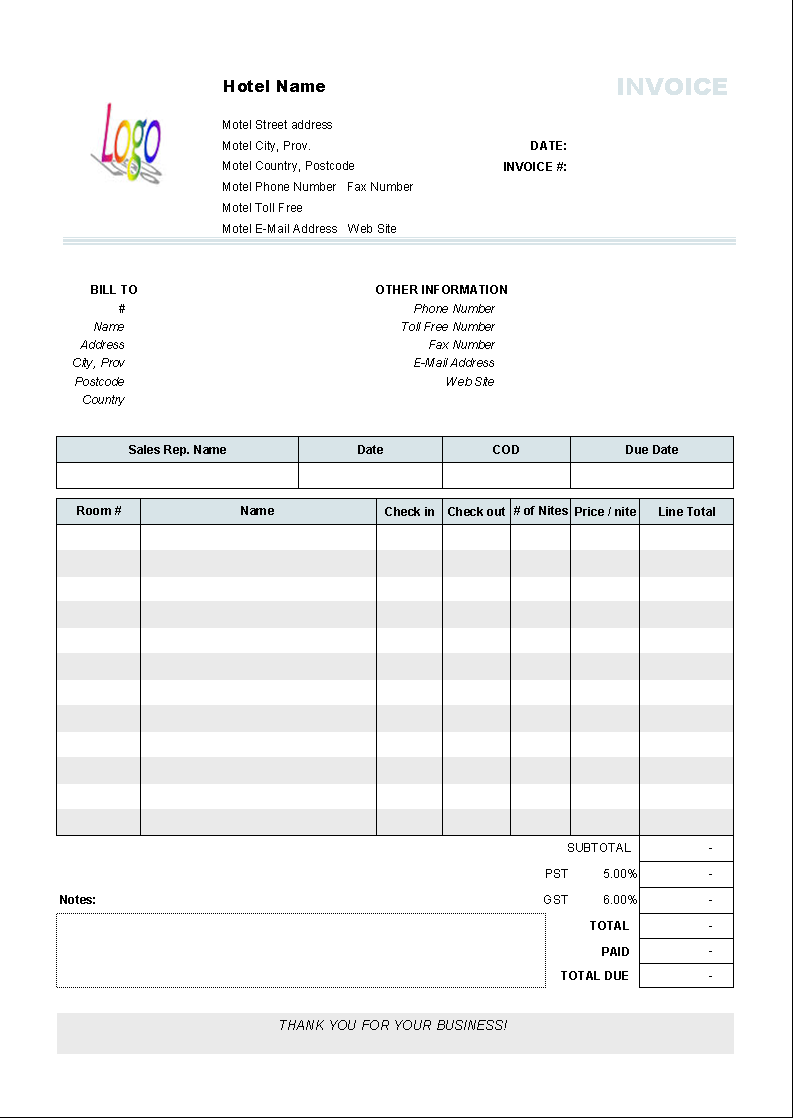

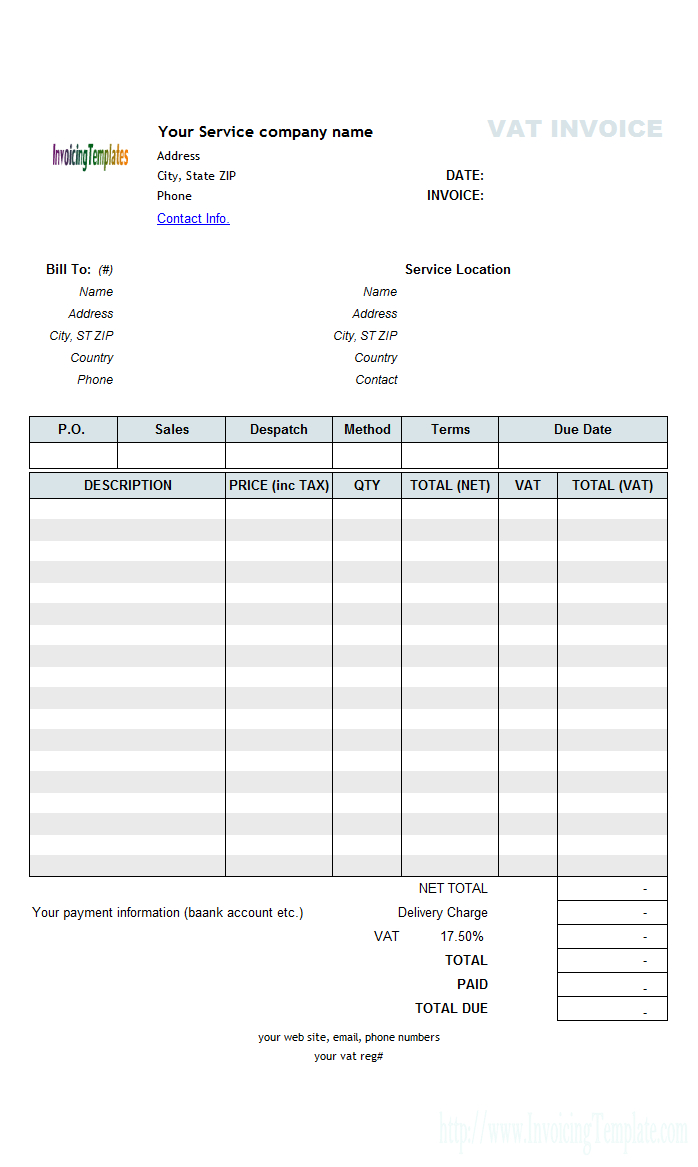

You would normally see something like the following examples: “Retainer for legal services (ten hours, senior associate)” “Provision of professional services outlined in attached timesheet” “Sale of Car: 1978 Fiat Panda registration number 123456” “Painting of garage door, 123 Main Street, Little Bigtown” “Performance of agreed services under our contract dated 01 July 2014” “January retainer fees.” Alternatively if you want to itemize items with line totals you should look at our Services Invoice Template and our Sales Invoice Template.ĭon’t forget, when dealing with cross-border transactions you should include the currency. This is where you describe the goods and services provided. More invoices here: PandaDoc Invoice Template Gallery If you use this Proforma Invoice Template for a company you should include all details from your company’s letterhead (full company name, registration number, logo etc). For sale of goods or services you should start with the Sales Invoice Template or the Service Invoice Template. If you would prefer to start with a blank invoice you can use our Blank Invoice Template. If you are in doubt about whether it is appropriate to use a Proforma Invoice you should seek the opinion of a local accountant. Please note that there may be local laws or rules surrounding the use of proforma invoices instead of normal invoices (especially if they contain VAT or sales tax).

Proforma Invoices are commonly used where the company requesting payment is unsure as to whether the client will make payment or for some reason does not want the transactions to appear in their books until it is paid (usually either to avoid paperwork, to prevent artificially inflating their P&L or for other accounting or tax reasons). Proforma Invoices do not form part of the accounting records of the company and, once paid, proformas are normally discarded and a formal invoice is raised to replace them.

A Proforma Invoice is a non-fiscal invoice (or informal request for payment). This is a template for a Proforma Invoice.

0 kommentar(er)

0 kommentar(er)